Thursday, December 31, 2009

Chinese Buying Mattresses for US Dollars

Don't believe me? Click here: http://www.treasurydirect.gov/instit/annceresult/press/preanre/2009/R_20091230_1.pdf

Why would anyone give the US Government $5B so that they can get the same $5B back at maturity?

(1) US Citizens feeling patriotic and lending Uncle Sam some walking around scratch?

(2) Financial institutions being forced to buy T-Bills whether they want to or not?

(3) Things will be so bad in 2010 that just getting your money back will put you ahead of the game?

This is the equivalent of putting your money in a mattress.

In these times, perhaps it is best to turn to the largest single holder of US dollars and debt-- the Chinese government to see what they are doing.

Here is what I found in the WSJ (12/29/09):

"BY JAMES T. AREDDY

SHANGHAI—A group of financiers is trying to put a U.S. mattress maker now under bankruptcy-court protection into play by encouraging Chinese bidders to top an already arranged offer for Simmons Bedding Co., according to people involved in the effort."

Somehow I feel these two items are connected...

Tuesday, December 29, 2009

What befalls autumn bees

Money is the food of governments. It is the “mother’s milk” of politics. Did you notice that governments are now acting like autumn bees? Everything is a crisis. No time to read the legislation—just pass it! The taking of money and demand for legislative financial favors is at its pinnacle. What can’t be taken from the people will be printed.

As the money supply increases, the quality (value) decreases. Like bees with no honey, governments see the end of money.

But unlike autumn bees, what will bee-fall our hive?

To learn more about bees: http://en.wikipedia.org/wiki/Bee

To lean more about governments: http://en.wikipedia.org/wiki/Atlas_shrugged

Wednesday, December 09, 2009

Where Have All The Pictures Gone?

Since then there has been nothing. What do you think? Did everyone suddenly get happy? Is there Censorship? Does the press not cover riots and protests anymore?

Something happened to the people of the world during March 2009...

It is not that there aren't things for people to be upset about, they are just not taking to the streets or, if they are, the pictures aren't getting out:

2009.12.06 Radio Liberty: "Workers at Russia's Molot arms plant haven't seen their salaries in nearly six months. Unable to meet payroll, management has resorted to passing out food parcels to its increasingly angry and desperate employees." "This is partially related to the devaluation of the ruble and the accompanying rise in inflation. The buying power of workers has fallen approximately 40 percent. We don't see this situation improving."

2009.12.09 AFP: "GENEVA (AFP) – Unemployment in Switzerland soared to a five-year high ..." "The Swiss government said last week that it would halve from next year its quotas of permits for workers from outside Europe in a bid to curb unemployment."

2009.12.07 Washington, D.C. - infoZine - "The global financial crisis is having a devastating impact on families in emerging Europe and Central Asia, with the risk of the region giving back a fifth of the poverty reduction gains of the past decade, according to a new World Bank report. By 2010, there could be over 10 million more poor people in the region, and close to an additional 25 million more who were almost middle class but now just above the poverty line with the potential of losing their homes, jobs, and basic services."

2009.12.07 New York Times - "BANGALORE, India — In the United States and Europe, people worry that their well-paying, high-skill jobs will be, in a word, “Bangalored” — shipped off to India."

2009.12.08 The Vancouver Sun - "Financial markets tumbled on Tuesday as credit rating agencies slashed Greece and Dubai government-related debt and contemplated the potential debt rating downgrades of the United States and U.K., as both countries struggle to deal with large fiscal imbalances and accumulated debt that have resulted from the global crisis. "Anybody who thinks we are through this credit collapse is delusional," said David Rosenberg, chief economist and strategist at Gluskin Sheff in Toronto. "It is ongoing."

2009.12.09 Bloomberg - "Greece’s socialist government, elected in October, plans to cut the budget deficit to 9.1 percent of GDP next year from 12.7 percent this year. In contrast, Ireland’s Finance Minister Brian Lenihan will announce plans today to cut spending by 6 percent in the face of the worst recession in Ireland’s modern history." “There’s certainly an element of panic and hysteria,” said Peter Dixon, an economist at Commerzbank AG in London. “The ECB will bend over backwards to ensure that one of the countries within its orbit doesn’t default."

2009.11.07 New York Daily News - "President Obama signed a $24 billion economic stimulus bill into law... The law provides another 14 weeks of benefits to all out-of-work people who have exhausted their benefits... in states where the jobless rate is 8.5% or more get an additional six weeks. The extra 20 weeks could push the maximum a person in a high unemployment state could receive to 99 weeks, the most in history."

HERE ARE SOME PICTURES FROM THE FEDERAL RESERVE DECEMBER 2009 MARKET REPORT (Click to enlarge):

No social unrest in the US because the government continues to subsidize unemployed workers. Now you can get benefits for almost a full two years. The unemployed are staying unemployed longer than any time in US history.

Of concern is the fact that even with continued extensions of unemployment benefits, continuing claims are dropping. Since total unemployment has not improved and continuing claims are falling, this can only mean people are falling through the US social safety net.

Tuesday, December 08, 2009

The Value of Lost Data

"SCIENTISTS at the University of East Anglia (UEA) have admitted throwing away much of the raw temperature data on which their predictions of global warming are based. It means that other academics are not able to check basic calculations said to show a long-term rise in temperature over the past 150 years. The UEA’s Climatic Research Unit (CRU) was forced to reveal the loss following requests for the data under Freedom of Information legislation."

Fortunately, we no longer need the data because everyone accepts that global warming is occuring but the technique here can now be used in Copenhagen.

The plan is for Developed countries to emit less greenhouse gases in the future while Developing countries will be allowed to emit more. The idea being that at some point in the future, all countries will have contributed the same amout of greenhouse gases into the environment and then we will have another meeting.

Since developed countries have contributed the most green house gases and therefore have all the historical data, they will be in charge of keeping score going forward.

If, in the event Developed countries don't like the score going forward, they will simply lose their data and calculate events as they see fit.

After all, it is one of the worlds most greatest diplomats that said, "those that vote decide nothing; those that count the votes decide everything".

Look it up....

Wednesday, December 02, 2009

How to Transfer Wealth

I just picked a bank at random and retrieved these figures for 12/1/2009:

For savers: 12 month Certificate of Deposit: 1.25 % return

For borrowers: Credit Card Interest Charged: 19.99% ; 30 Year Home Mortgage: 4.875%

20 Year Home Equity Loan: 6.49%

So it would seem banks would be lending lots of money because the rate at which they pay versus the rate at which they charge is really big. They should be making tons of money!

But they are not lending because even though the spread is huge, there is a risk free way for them to make even more money.

STEP (1): The US Federal Reserve bank creates money out of thin air and makes it available to preferred banks at near 0% interest.

STEP (2): Preferred banks borrow money from the Fed at 0%.

STEP (3): The Preferred banks use this money to buy US Treasury certificates that yield more than 0%. Example: 10yr yield is greater than 4%.

STEP (4): US government pays the interest to the preferred banks using Taxpayer dollars.

WHY BANKS DON’T LEND:

So… if you were a bank, why would you ever lend any money to individuals when you can lend it to the US government who will in turn take money from its citizens to pay you back. All this accomplished by using money that doesn’t really exist which you borrowed at 0% interest.

WHY AN ASSET BUBBLE IS FORMING:

Shaving a couple of interest points from the US government can get boring after a while. So, why not take some of that money and start buying domestic and foreign stocks. After all, the money is free and you, plus other banks, will all start buying and pump up the stock market creating a “herd mentality”. Maybe even get your friends at the FED to buy index futures with additionally manufactured dollars to really accelerate the rise in the stock markets.

WHEN WILL FED INTEREST RATES RISE?:

Never. What has been created is a massive “carry trade” at an unprecedented scale that can never be unwound. Besides, in the old days the FED raised rates so banks, in turn, would raise rates to cool down the economy by making credit tighter. Credit is already tight at 0% so there is no need to raise rates because it would have no effect.

WON’T ALL THIS MONEY CREATION CAUSE INFLATION AND REQUIRE THE FED TO RAISE RATES?:

No. We are in a well hidden deflationary spiral. As more and more individuals have less and less money because it is being taken away from them or they are jobless, local prices will fall- eventually resulting in labor rate parity world wide.

When people can’t afford things the price naturally falls. This is why the US housing market is not done falling and won’t stop until median home prices begin to align with median incomes.

Imported goods will become more expensive and therefore appear inflated but that is just currency effect without change in real prices. However, imports will slow because no one can buy them- eventually resulting in global economies becoming regional. That is- local goods, produced locally and consumed locally.

And besides, the FED is not really creating money because the money is not being allowed to fully enter the economy. We are simply point shaving here and the preferred banks only have to pay back the principle (0% interest rate effect) or even if they default- who cares the money didn't really exist in the first place!

Tuesday, November 24, 2009

My Healthcare Solution For The U.S.

(A) There is nothing wrong with health care in the United States. The Healthcare debate is about money.

(B) Today in the U.S., whether you can pay for it or not, everyone gets some form of healthcare.

(C) With US population growth near zero, the healthcare costs of the U.S. will be basically flat plus inflation in the future.

(D) There are three "costs" that occur within the healthcare system that do not contribute to healing and prevention. (1) Fraud, (2) Poor Productivity, (3) Insurance Company Profits. All three of these must be eliminated which further ensures point (C) above will be true.

(E) Fraud and Poor Productivity can be eliminated through the use of Information Technology provided some effort is put into business process re-engineering.

(F) Insurance companies would be required to operate at zero profit plus investment recap for their health insurance units. They can also leverage their back office operations with their other "for profit" insurance units (auto, home, etc.) to gain some economic advantages.

(G) Since Federal and State governments of the U.S. already provide more than 50% of the health care insurance coverage already, a government provided insurance option can be provided for those not wishing to buy private insurance. Government insurance programs for the poor and aged would continue as they do today.

(H) Those who remain uninsured, consume healthcare services and then refuse to pay for those services will be pressed into community service at healthcare institutions until their debt is repaid.

(I) Businesses may provide insurance coverage for their employees and/or self-insure as a means of retaining talent.

(J) Second amendment rights will ensure the government won't ration health care because the American people won't stand for it. The politicians will lose their jobs or worse.Today my parents are covered by US government provided medicare and they buy additional insurance ("medicare supplement") from a private insurer to cover things that Medicare does not provide. What is wrong with that for all US citizens?

You see, if the arguments could be reduced to the facts and points above, we could make progress. But there are groups at work who are positioning the legislation such that their real agenda can be carried out later. And it is these groups for which the common citizens are most afraid and why protests are mounting:

#1) The anti-population crowd that believes there are too many people already and that death should be hastened for the unproductive and reproduction should be curtailed. Their basis lies in the belief that the planet's biggest problem is people.

#2) The anti-capitalist crowd who believes that anything that provides equal opportunity without equal outcomes must be eliminated.

#3) The anti-freedom crowd who believe that they know what is best for people and plan to use the provision or denial of healthcare to control people.

#4) The usual suspects that create massive legislative works in order to enrich themselves, their friends, or people who helped them get elected in the last election.

Saturday, November 07, 2009

Federal Reserve concerned about its own solvency

Federal Reserve people are like scared ducks in a pond. They look calm on the surface but underneath the water they are paddling furiously. That's why you need to really look at what they are saying in these reports because it all sounds quite benign. It isn't.

"In order to promote a smooth transition in markets, the Committee will gradually slow the pace of its purchases of both agency debt and agency mortgage-backed securities and anticipates that these transactions will be executed by the end of the first quarter of 2010."

Agency debt is one of the reasons the financial collapse started. Agency debt is created by surrogates of the US Government created by the US Government. The US Government has taken no action AT ALL conerning US Sponsored Agencies, their policies, practices nor the legislation that mandates their actions and behavior. Everything that has caused the intial problem has continued, unabated, and even somewhat augmented by stimulus activity.

The Federal Reserve bank is basically saying in their report, "We've been buying your crap to keep you afloat. While we were risking our own solvency, you did nothing. Starting 2Q10, you are on your own".

===> If you are in the US and most of your holdings/cash are US dollars, you probably need to find an entry point to buy more gold. The price of gold is not going up. The value of the dollar is going down which makes it look like gold is expensive. We are just getting started.

Saturday, September 12, 2009

Connecting the Dots on Electricity

Something big is about to happen with electricity and it is going to happen soon.

I have selected 3 videos about electricity from TED.COM. Watch them in sequence and tell me if you connect the dots the way I do.

VIDEO #1:

Concept: Shai Agassi wants to put you behind the wheel of an electric car -- but he doesn't want you to sacrifice convenience (or cash) to do it.

What To Watch For: This not about an "invention". This is about a fundamentally new business model for the consumer of automobiles, the auto industry itself and the companies that provide energy.

http://www.ted.com/talks/lang/eng/shai_agassi_on_electric_cars.html

VIDEO #2:

Concept: Eric Giler has a plan to beam electric power through the air to wirelessly power your laptop or recharge your car. You may never plug in again.

What To Watch For: The live demonstration on stage. It works.

http://www.ted.com/talks/eric_giler_demos_wireless_electricity.html

VIDEO #3:

Concept: John La Grou, a long-time electronics inventor, audio designer and entrepreneur, wants to save lives and energy with a new, smarter type of electrical outlet.

What To Watch For: This is the answer to how we can consume electricity for new things (like cars) without increasing our total consumption of electricity. It works.

http://www.ted.com/talks/lang/eng/john_la_grou_plugs_smart_power_outlets_1.html

THE FUTURE IS "BRIGHT":

The last 200 years of human development has been immeasureably accelerated due to cheap and plentiful sources of energy. Cheap compared to doing the work manually or with donkeys-> 1 Barrell of oil = 5.8 million BTUs = 23,200 hours of human labor (agricultural standard). Because energy is so cheap, we have been able to do almost everything with practically nothing. This transformed modern society.

The good news is that limitless, cheap electrical power will remain with us. According to Ray Kurzweil , "We also see an exponential progression in the use of solar energy," he said. "It is doubling now every two years. Doubling every two years means multiplying by 1,000 in 20 years. At that rate we'll meet 100 percent of our energy needs in 20 years. [with solar power]"

In summary:

- The new business model for private transportation has been defined and some country somewhere will adopt it.

- The ability to transmit electricity wirelessly has been proven, it will now be perfected.

- The rate of progression of solar power is an exponential curve.

- Legacy forms of energy production are requiring more and more energy to produce energy due to "high grading"

- Smart outlets are a bridging technology providing safety and extraordinary savings.

Friday, September 11, 2009

My New Corvette

More details coming on September 14, but here is what we know now (from above hotlink):

Details of GM's new Satisfaction Guarantee:

· Offer covers 2009 and 2010 Model Year Chevys, Buicks, GMCs and Cadillacs (except medium duty trucks)

· Customers (one per household) can return their vehicle between 31 and 60 days with less than 4,000 miles

· Customers will be informed in writing before they buy the vehicle of the terms of the Satisfaction Guarantee

· Customers must take delivery by Nov. 30

· The Satisfaction Guarantee covers the vehicle purchase price and sales tax, but not other add-ons like accessories, negative equity on a trade-in or other fees; other restrictions apply

· Leased vehicles are not included

· More details are available beginning Monday, Sept. 14, online at [Chevy][Buick][Cadillac][GMC].com/guarantee

Wednesday, September 09, 2009

Simple Truths

HISTORY: The US Government (USG) coined this phrase to apply to US based, multinational financial institutions whom upon failure, would trigger a systematic collapse of society as we know it. In addition, the USG was also sending a strong message to the rest of the world that America is "too big to fail".

IMPLICATIONS: The rest of the world will bail out the US since they cannot afford the alternative.

Convert Debt to Equity:

HISTORY: Rather than the USG "loan" money to "too big to fail" multinationals, it purchased equity (normally preferred shares) in target companies. When the auto companies went bankrupt, the USG wiped out the debt holders, drove the share price to zero, but converted the value of the company to "new equity shares" which it doled out to its political supporters.

IMPLICATIONS: Therefore "debts" whether they be financial or poltical are paid off in equity. China holds $2 Trillion in US treasuries and federal reserve notes. Since we cannot pay them off and will not risk a default, the USG will give Alaska to China.

Who Gets the "First Mover Advantage":

HISTORY: Demographics in developed countries show that there are more and more older citizens and less and less younger citizens as a percentage.

IMPLICATIONS: There will be less and less younger people wanting to buy my stocks, bonds, real estate and other things therefore my nest egg will shrink due to simple supply and demand. So older people (the majority) will vote in politicians who take from the young to give to the old.

IMPLICATIONS 2: In order for the young people to stop getting squeezed by older people there will be a systematic process by which older people are removed from existence and their assets transferred to those who weren't going to buy them in the first place. This process is referred to as "healthcare reform".

Tuesday, September 08, 2009

Maxine on Bailouts

Thank you to my commentators who have sent disputed evidence. All comments have been removed as well.

Tedbits

Wednesday, September 02, 2009

Pledge Allegiance To Debt

This is worth a visit: http://defeatthedebt.com/

Watch the TV commerical:

Monday, August 31, 2009

Highlights from the 2009.Q2 FDIC Report

INSURED INSTITUTION PERFORMANCE

1) Higher Loss Provisions Lead to a $3.7 Billion Net Loss

4) Net Interest Margins Show Modest Improvement

5) Industry Assets Decline by $238 Billion

US Children Fund GM-CHINA Deal

A bankrupt company taking money from the US government; money which the US government acquires by selling US debt to the Chinese whereby the future generations of the Americans are left to pay the interest.

Debt is future consumption pulled forward to the present. The result is less consumption in the future or default because--- nothing is growing faster than debt.

Thursday, August 27, 2009

Chatter

If this is wrong what is the worst that can happen? You squirrel away 3 months of living expenses in your floorboards that could have been in a financial investment earning 0.05%.

People don't prepare because they are afraid of looking foolish.

http://tedbits.blogspot.com/2008/10/bank-holidays.html

Saturday, August 22, 2009

Greenback Emissions

Anyway, his comment reminded me that I haven't written about something that I think is very important.

The Federal Reserve and the US Treasury have been placing well timed trades in the S&P Futures markets since early March. Some of this you can see on the balance sheet of the Fed. Some you can't because it is being held off-balance sheet.

Such futures action makes it look like the stock market is going to go up. This results is really smart people front running this trend and less smart people putting money in the market driven by herd mentality.

At some point this will stop. Further, at some point those positions may have to be unwound.

What do you think will happen then?

Now that you read this please remember that any information that follows is neither a solicitation to buy or sell securities. The writer of this article may or may not own such securities at the time you are reading this article. And, don't be a complete idiot-- do your own research before you buy financial instruments of any kind.

Tuesday, August 18, 2009

Sold Out

Since some of you may have been following along from the market report I gave on March 20 (http://tedbits.blogspot.com/2009/03/bulldog-returns.html), I wanted to let you know that as of today, I am completely sold out of the above holdings and related equities. Signals were clear as of the first week of August that the market was weakening and I systematically tightened up my "stops". Over the past few weeks I have been taking money off the table and as of today, I am completely out. It was a great run.

I still believe in the China Recovery/Commodity Strategy but will not buy back in until I see a good 10%-15% retrenchment from current levels. My short position on the US Dollar is now closed and I am neutral on the dollar at this point. I like gold at $880/oz.

Other things I am watching:

Blackstone (BX) after it goes ex-dividend. Would love to see this at $10/share and probably start nibbling at $12.

China Battery (CBAK) at about $2.50/share.

And of course GLD, UDN, DBB, DBC, DBO after proper retracement.

For a speculative trade consider Image Sensing Systems, inc. (ISNS). Be very careful though because this stock is thinly traded. I am hoping for some institutional investors to move in on this one and send it to the stratosphere. I continue to have a minor position in ISNS.

It is possible that we will form a double bottom (http://tedbits.blogspot.com/2009/04/decoupling-double-bottom.html) because uncertainty is reoccurring in the financial markets as commercial real estate loans are defaulting.

Lastly, I must say I am getting more and more confused about inflation vs. deflation. I really believe we are heading for inflation if you've followed previous posts. However, I have read some compelling cases for deflation from reputable sources. The most clever point I read was a prediction for inflation in necessities and deflation in discretionary purchases. Ever since I read this it convinced me that this is probably our future.

Saturday, August 15, 2009

Oxygen

Here is the next topic to watch for: Oxygen

You see, global warming is getting old. And after 11 years of cooling temperatures the polls are showing "it isn't selling" anymore.

The same thing happended in the 1970's and 1980's when the big thing was the "next ice age" that was soon coming. During these decades temperatures were actually warming.

Whether warming or cooling, it seems we just can't get the world to buy into the catastrophe of dramatic climate change. We can't generate enough fear.

Now there is something brewing that will really scare people. The world is running out of oxygen. You haven't heard much about so far because we haven't figured out a way to blame human behavior. But as soon as we do, watch out.

If you are still part of the greenhouse gas crowd... remember most of the green house gases in the atmosphere are NOT man made. Here is a link to a prior posting

Monday, August 03, 2009

Friday, July 31, 2009

Inflation Unwind?

The problem I see is that the amounts being bought month after month by these primary dealers exceed the cash on hand in the balance sheets. This means that the transactions are being conducted off balance sheet and someone is giving them the money to do the purchase. There are only two entities large enough to fund such actions: (1) the Federal Reserve itself could print the money and give it to the PDs off-balance sheet or (2) The CBO China could do it (but I doubt it).

Action (1) above is essentially quantitative easing [printing money] but being performed in a way that is invisible. This is becoming too big to unwind with annual US debt approaching $2T/year. This means inflation.

While I strongly feel that Action (1) is happening, I was is a discussion group with a fairly intelligent Conspiracy Theorist who believes Action (2) is happening. His idea is that Countries conquering other countries through war is passe'. He believes the 21st Century conquering is done by one country simply purchasing another. It is bloodless, doesn't destroy valuable assets and allows the respective economies of both countries to stay intact. He laughs when I point out that I think the US should sell Alaska to China by saying that I am only partially right. He contends that the whole country is being sold for the purpose of creating a New World Order, elimination of the United Nations, a the formation of a "Mega Country" [China US merger] which will control the world.

When I hear stories like this it makes me think my assessment of the situation is very rational. I think off-balance sheet is happening in a very big way.

Keep an eye on UDN, it is a method for US Citizens to short the dollar.

Tuesday, July 28, 2009

Customer Relations

http://tedbits.blogspot.com/2009/06/customer-segmentation-on-global-scale.html

And is based on a new article reported here: http://apnews.myway.com/article/20090728/D99NE5E00.html

Here is your bottom line:

"Obama dispatched his top economic officials - Treasury Secretary Timothy Geithner, National Economic Council Director Lawrence Summers, White House budget director Peter Orszag and Federal Reserve Chairman Ben Bernanke - to try to reassure China that the U.S. will not let deficits or inflation jeopardize the value of Chinese investments.

U.S. briefers said the president's team told the Chinese that the United States was committed to making sure the economic and monetary stimulus being used to fight the recession did not fuel inflation.

The Chinese, who have the largest foreign holdings of U.S. Treasury debt at $801.5 billion, have been expressing worries that soaring deficits could spark inflation or a sudden drop in the value of the dollar, thus jeopardizing their investments. Chinese officials said those concerns were raised during Monday's talks."

What do you think happened? Vote here with your reply:

(A) The Chinese accepted the words of the US government officials because they like fancy speeches and are enamored with clever Americans.

(b) The Chinese asked for and got financial concessions (like inflation protection) for their $800+B investment

(c) The US offered to sell Alaska (after all the US is not using it for anything) to the Chinese for all the US Dollars held by the Central Bank of China and the retirement of all US Debt held by the Chinese

(d) The US Government told China that they (China) were really screwed because we plan to crash the dollar and not pay on any of the debt. [Known as the Argentina Solution]

You can reply anonymously, so let's hear your vote.

Friday, July 24, 2009

Cowboy and Street Thug

Back in March is posited the following: China and Commodities Will Recover First

It was harder to make money under the cowboy but the new guy is so predictable that this is like taking candy from a baby. No wonder Wall Street loves him and no wonder they supported his election.

The cowboy operated under UN Resolution 1441 and there was no doubt what the end game would be: If the United Nations was to have any credibility then American blood would have to be sacrificed. He wasn't a smooth talker but there was no doubt about his willingness to step into the street for a gun fight. UN Resolution 1441 authorized military action against IRAQ and he took it.

Today we have the new guy. And, we have IRAN. Everthing was fine with a the December 2009 deadline on nuclear ambitions but the new guy decided to publicly move the deadline up to September. There is no UN Resolution that IRAN comply with this on any date! We are mano y mano now baby!

What happens in September?

(a) Will IRAN suddenly capitulate to the United States?

(b) Will the US attack IRAN, without a UN Resolution allowing such, because they didn't meet the September deadline ?

(c) Will the US have its surrogate ISREAL attack IRAN so the US can save face?

(d) Will IRAN ignore the US demand thus allowing a smoother talker of nuance, to point out the differences between cultural calendars and timekeeping that were no doubt at the heart of a timing snafu?

Given that (a) isn't going to happen all the remaining options are financially destablizing with a commensurate "flight to safety" to follow. With US Treasuries increasingly doubtful as "safe" given US government insolvency, some money will go into commodities and China. The dollar will collapse either because the US cannot fund another war, properly pay its surrogates, and/or lose its standing as a world leader.

I continue to like DBA, DBB, DBC, DBO, FXI and GLD.

Thursday, July 09, 2009

Computer Pgm To Manipulate Markets Stolen!

PROCEEDINGS BEFORE MAGISTRATE JUDGE KEVIN N. FOX,

UNITED STATES DISTRICT COURT

What follows is an excerpt from page 8...lines 3 through 7...

3 activity. In addition, because of the way this software

4 interfaces with the various markets and exchanges, the bank

5 has raised a possibility that there is a danger that

6 somebody who knew how to use this program could use it to

7 manipulate markets in unfair ways.

I am not a lawyer but I play one in the blogosphere. So let me interpret this testimony and then ask some hypothetical questions (which have nothing to do with the case).

FACT: Plaintiff has stated, as a fact, that the program can be used to manipulate the market in unfair ways.

QUESTIONS:

- How would you define manipulate?

- Does Goldman Sachs' use of the program constitute manipulation?

- Would not such manipulation affect the market both during and after the fact of the program's use in both direct and indirect ways?

- How would you define fair?

- Does Goldman Sachs' use the program to manipulate the markets unfairly? (this is like asking have you stopped beating your spouse)

- Is there a qualified, independent body that examines Goldman's use of the program to ensure compliance and absence of malfeasance?

Full text of testimony is posted on SCRIBD here is a convenient link: http://zerohedge.blogspot.com/2009/07/aleynikov-transcript.html

Friday, July 03, 2009

California won't accept their own IOUs?

Here's the irony: Let's say you were a contractor and did some construction work on state owned building. The state government will give you a registered warrant (IOU) that means they will pay you at a later date. However, if you hold CA Registered Warrants and want to use them pay any bill you owe to the state like taxes, licenses or workers compensation insurance, California will not accept their own warrants in return.

Don't believe me? search their own site: http://www.ca.gov/

Thursday, June 25, 2009

How to make money on cap and trade

Cap and trade sets of up a market for trading greenhouse gas "allowances". This means that there will be a market for futures and futures markets will also provide the opportunity for index type investments. Those investing in all these vehicles will seek to hedge their upside and/or downside risk providing for the creation of collateralized obligations and offsetting credit default swaps.

Sound familiar? This is Financial institution's dream come true- a gift from the US Gov.

My point is... get in now... establish your position...and don't be greedy. When wall street and the USGov team up, you've got to be "in the game".

If you make a ton of money you won't care that your electric bill grew by 50%, US manufacturing completely shut down, and gasoline is $8.00 a gallon. In fact, you will facilitate the whole process by being one of those individual investors that is helping provide liquidity to those efforts to remake America.

The informed will make money, the poor will get tax credit offsets and those in the middle and those frozen in the headlights will foot the bill.

------------- I hate long posts but if you want to know how this all going to work:

I read the legislation, so let me bottom line it for:

- Each year the USGov decides how much "man made" greenhouse gases can be introduced into the atmosphere by citizens and companys for which the USGov has jurisdiction (call this "the allowance").

- Some of "the allowance" is allocated to citizens and companys. They will not get enough of "the allowance" to actually operate in a given year.

- The rest of "the allowance" is given to Agencies of the USGOV or Non-Governmental Organizations who do not actually emit greenhouse gases but can "sell" their portion of "the allowance" to those that have been "underallocated". They will no doubt sell 100% of their "allowance" because they don't need an allowance to begin with. Get it?

- The combination of 1, 2 and 3 above are a simple formula for taxing everyone in line #2.

- These taxes are then either (1) passed on to the consumer or (2) avoided by curtailing production in the US [loss of jobs].

- While reduction in greenhouse gas emissions can be measured, the affect on global warming cannot since there are too many other variables at play. Hence, the success at raising taxes is a certainty; the reduction in global warming is not.

- Only Western Europe and the US are pursuing these policies. China and India are not since they have several billion people to keep happy.

Thursday, June 11, 2009

We need a failure Czar

Speaking of infallibility. If "we learn from our mistakes", don't you think that failure is too important to leave to chance?

If I am "too big to fail"; does that mean I am "too big to learn"?

And speaking of education, wasn't it Benjamin Franklin, that great British separatist who noted, "The only thing more expensive than education, is ignorance"!

But I disagree. Ignorance is the domain of the innocent (ex: little children). We are really talking about stupidity and stupidity comes with experience.

This is why "History Repeats Itself" or better-- People repeat history.

So now I offer you some history about what happens when there are too many Czars with too much power, who answer to no one:

- In January 1905, an incident known as "Bloody Sunday" occurred when Father Gapon led an enormous crowd to the Winter Palace in Saint Petersburg to present a petition to the tsar. When the procession reached the palace, the national police force opened fire on the crowd, killing hundreds. The people were so aroused over the massacre that a general strike was declared demanding a change in government. This marked the beginning of the revolution and the country was paralyzed and politicians grew desperate to keep their positions of power.

- Rumors where then circulated that food and fuel would soon be in short supply and inflation was mounting. Strikes increased among formerly self-sufficient citizens who were forced to take low-paid, government jobs mostly in the military. The media, typically friendly to the government, feared for their existence and spread public distrust of the regime so that they would be seen on the side of the people who, by now, had organized themselves into well-armed regional militias.

It didn't go well for the Tsar; so what can we learn from his mistakes:

- Don't allow the people to arm themselves,

- Maintain control of the media,

- Get the bankers on your side by giving them lots of money,

- Don't leave community organizing to chance, fully fund it so you can control it,

- Make sure the people are less afraid of you and more afraid of something else (like pensions, flu, healthcare) -- maintain "rock star" status if you can (see point 2 for help),

- Find your semi literate, mystic Grigory Rasputin equivalent before it is too late.

Tuesday, June 09, 2009

Customer Segmentation on a Global Scale

Most "good" customers are those that drive volume purchases. The seller usually offers a discount to the buyer and, in turn, the buyer buys large volumes. Both buyer and seller win.

Sometimes the key customer doesn't get a discount but rather some other consideration. Perhaps a rebate to be delivered at a later time. Perhaps preferential treatment that is hard to value but valuable none-the-less because it is not available to "lesser" customers.

China is the United States' most important customer when it comes to buying US government debt.

Why did Pelosi go to China? Why did Geithner go to China? Who will be next to pay a "sales call" to this most revered customer of US Debt.

Have you or your broker or your pension or your 401K bought any treasury bills lately. Do you think they (you) are getting the same deal as China? Are we all paying the same price? Are we all getting the same advertised, published return on investment?

What am I thinking here? I am quite sure we are all paying the same price and we are all getting the same benefits regardless of who is big and who is small. I mean after all, isn't it really all about fairness and a "level playing field"?

When is the next auction, I heard they are serving General Tso's Chicken....

BTW you've got to watch this if you like General Tso' Chicken...

http://www.ted.com/talks/jennifer_8_lee_looks_for_general_tso.html

Tuesday, June 02, 2009

Should I buy GM?

Buying the stock:

(1) All the people who are going to own the stock after bankruptcy intend to sell it for cash. The government says it want's out. The Labor Union intends to sell the stock to pay for medical benefits. When there are more sellers than buyers a stock goes down.

(2) I heard Bob Luntz (Former Chairman of GM) on TV (2009.06.02) and he said GM will do well because the US dollar is weakening and this makes GM more competitive. When a Chairman is counting on currency for success you know this is a problem.

(3) He further indicated that the new breakeven point for GM is 10Million cars per year. Since "we" haven't been making any cars with "our" plants idled and "we" are cutting "our" product line in half and "we" are dramatically shrinking "our" dealer network; I couldn't exactly figure out how this is going to happen. He further implied that with 2million new drivers on the US roads each year; achieving breakeven was within reach. What do you think of a former Chairman focusing on breakeven rather than profitability? Emphasis mine: If you are a US taxpayer then you own GM; if you are not a US citizen but your country buys US Treasuries you are an effective owner of GM too!

(4) GM is now a referendum on Obama. Therefore this must be successful. Same with Chrysler. But not the same with Ford who didn't need mother's milk. If Ford is successful and GM is not... well, you get the picture.

(5) The Chinese are buying Hummer. Perhaps the recent visit by our Treasury secretary sealed the deal. I am sure they paid as much for Hummer as Fiat is paying for Chrysler. But I seriously doubt you will be able to find ANY reliable information on the terms of the sale or related recourse liabilities assumed by the US government (er... I mean GM corporation).

So my final anaysis is 3 sell signals; 1 buy signal; 1 neutral.

In any case, there are so many better places to put your money, why buy a car company? Did you throw money at the airlines when they were/are going bankrupt?

Should you buy a GM Car?

Yes... but only if it is a Saturn. ;-)

Friday, May 22, 2009

Californious est omnis divisa in partes tres

Similiarly we await our modern day Caesar to proclaim the future of the vanquished, bankrupt piece of geography known as California. The 8th largest economy of the world is insolvent and they are too big to fail.

If we accept that patterns of the past will guide our future then permit me to run a scenario. Chrysler was too big to fail and the recovery plan in place for this major car company may be just the answer to the California problem. Let's get started:

The current plan is that 55% of Chrysler goes to its labor unions. 35% goes to the Fiat car company- an Italian company. Neither of these groups actually owns any significant portion of Chrysler today so they are getting 90% of the company at no cost. The remaining 10% goes to the original owners of Chrysler who, by the way, used to own 100% of the company [but not anymore].

Now for the entertainment portion of this posting:

THE CHRYSLER FORMULA FOR CALIFORNIA

(1) Let's give 55% of all assets in California to the state labors unions.

(2) For the 35% piece, we need to find a non-US constituent that willing to accept 35% of the assets (at no cost to themselves). I suggest Mexico. California used to belong to Mexico and it seems only proper to return at least a portion back to Mexico at this time. Fairness at work, don't you think? Plus I would suggest that the US Government also issue an apology too, just for good measure.

(3) The remaining 10% would remain with the citizens of California. Which means each home owner would own only 10% of their house. Same with their car, their 401K, their bank account, their motoways, their stadiums, etc. etc. etc. If you own a business in California, you would now only own 10% of it.

Oh, by the way, if you own any California issued bonds, they are worthless. Yes, I know that US law requires secured bond holders to be paid first, but that law was overridden, without recourse, by the US Government. No legislative oversight. No judicial review.

If it will work for Chrysler it will work for California.

Tuesday, May 19, 2009

A new one-world currency - Final Chapter

(1) http://tedbits.blogspot.com/2009/04/secret-societies-are-your-friend.html

(2) http://tedbits.blogspot.com/2009/04/worlds-8th-largest-economy-seeks-us.html

This final segment sums it all up. This is happening so fast that I began to get concerned that this treatise would be historical rather than predictive. Example: China allows the Yuan to be an international trade settlement currency-- that happened much faster than I thought it would.

PART III--- We are all going to be poorer together....

The concept of the EURO has its positives and negatives. And, as long as every sovereign nation sharing the currency is not failing "too much", it all works out. However, get a few "weak sisters" in the family and sooner or later the other brothers and sisters tire of carrying them. Keep an eye on Greece, Italy and Spain.

The UK didn't play the EURO game but that didn't make them immune. Their recent government bond auctions were under subscribed. That means no one wants your "IOUs" at the interest rate you offer or maybe at all. This is now happening in the US as the Treasury Auction has been under subscribed. No worries mate, the Federal Reserve (which is not part of the US Government but rather a private bank that the US government entrusted with the power to create money out of "thin air") will buy the bonds so the US government saves face.

Poor Iceland. Nobody wants their currency which means they can't buy anything. No one will loan them money because they don't have any money that is worth anything to payback the loan.

Actually, there are a lot of countries that are bankrupt-- some are doing desperate things. Zimbabwe is probably the worst. But, Argentina confiscated every one's pension savings. Venezuela is selling their soul to China. And, I could go on...

The risk of sudden military action is great. China has bought everything from mineral rights to political control in many countries. They are using US dollars to do it. What they can't buy they are now prepared to take as their military build up is approaching unprecedented proportions.

Don't think China will do it? You try dealing with several billion unhappy people all at once. Do I need to tell you what happens? You see, no other country faces the challenges that China does. No other country, nor its citizens, truly understands China's dilemma. And because we don't understand, we are in denial about what may happen.

But what about the US? Yes, quite a few "bad actors" has ruined the show for everyone else. The country entrusted to be the steward of the world's only "reserve currency". The country that is the world's policeman, who only asked one thing of every other country which was: "May we have a place to bury our dead soldiers who defended you?". That country created too many financial instruments that created too much dollars out of nothing. And when everything started to crash, continued to print more money to solve the problem.

“The significant problems we face cannot be solved at the same level of thinking we were at when we created them.”

Albert Einstein

But "printing money" in this sense does not really happen. It is more about moving numbers across a computer screen. Want to add more US Dollars to the world? Simply type in the desired amount into the Federal Reserve's computerized balance sheet. The rest is automatic. Quantitative easing, printing money, increasing the asset number on your balance sheet by typing it in... they all mean the same thing.

And every government is doing it. Why? Because it is easy and does not require any sacrifice from the people in that country. It keeps the current politicians in power.

But won't this burden future generations with debt, you might ask? No. Debt is only real if you plan to pay it off. Let me say that again. The only people concerned about debt are those that feel an obligation to pay the debt off.

Hence the emergence of Special Depository Receipts (SDR), the new world currency. It will not replace your country's currency but it will stand between your currency and the exchange rate of every other country's currency.

This means that there will no longer be a USD to EURO exchange rate. All currencies will be expressed in terms of SDRs.

So here is the sequence:

(1) All governments "print money" to deal with the economic collapse.

(2) Printing money results in inflation.

(3) Inflation hurts the people.

(4) All nations devalue their currency against the SDR

(5) The national debt of each country is reduced by the devaluation.

(6) Inflation is curtailed.

(7) Everyone is poorer because everyone's currency is worth less.

Now you understand why so much money is being printed and an unprecedented money grab is now underway. When everyone's currency is devalued, we are devalued together. But if I have been able to "front run" this devaluation and collect more pieces of paper now, I will be relatively better off than you when devaluation occurs. I got richer while everyone (including me) got poorer simultaneously.

The math is simple.

Epilogue: I know this is difficult to understand because it is hard to describe:

http://tedbits.blogspot.com/2008/12/gravity-and-inflation-point-of-view.html

But history tells us that the youthful America destroyed the Pound Sterling (a former global reserve currency). Also, the US Government confiscated gold from its citizens paying $28/ounce and then, when the deed was done, fixing the price of gold at $35/ounce basically devaluing everything by 25%.

It happened. It happens.

And now that you know what is going to happen, rest easy because there is nothing you can do about it.

Wednesday, April 29, 2009

With no compelling vision; Let's try some more fear

Also, for full disclosure, I took steps to prepare my family for the FLU outbreak 2 weeks ago, well before it was fashionable. I am ready, are you?

Now, let me tell you why I wasted my money and what this has to do with a "one global currency". You see, for currency collapse/replacement to occur, you must have rampant protectionism between countries to magnify the monetary problem. Nothing like a pandemic to enable countries to "close their borders".

World governments trying to solve a debt induced economic crisis with more debt and more printing money are coming to the harsh reality that this is probably not going to correct the problem within the next year or so, if at all. Iceland is bankrupt. More that 15 countries are now considered or labelled "near insolvent" including the UK, Greece, Spain, Ukraine, and some other smaller countries." China is swapping out of US dollars for natural resources. And the US Federal Reserve bank is forced to buy US Treasuries because their isn't enough buyers of US Debt.

The new problem is-- governments began to leak information that things were starting to look better. Their comments were based on second derivative thinking. And sadly, once you tell citizens that things are improving, you really own the problem if things get worse. Not good for continued employment as a politician.

But what if we could blame the next leg downward on a pandemic? No one could blame our governments if we suffer further economic contraction or at least failed recovery because of an "act of god".

Here are some facts which suggest the public may be being played for a fool again to ensure that if economic woes continue or worsen we won't blame the government.

(1) Actual SWINE FLU deaths in Mexico according to WHO is only 7.

(2) US government launches a media blitz to concern and scare its citizens (I've spared you a link to the inane comments of the US Vice Presidet).

(3) Average annual deaths in the US related to FLU: 36,000 per year

(4) Last FLU epidemic in the US? February/March 2008

(5) Percent specimens resistant to targeted H1N1 antiviral? 0.4%

Don't believe me? Go to the Centers for Disease Control.

Interesting isn't it? What do you think?

Saturday, April 25, 2009

A Decoupling Double Bottom

ng up for another major double bottom as was seen in the US during the late 1920's and early 1930's.

ng up for another major double bottom as was seen in the US during the late 1920's and early 1930's. Thursday, April 16, 2009

World's 8th Largest Economy Seeks US Government Help

Now the 8th largest economy in the world is asking the US Government to underwrite its debt which means they are asking the US Taxpayer to insure their debt.

News reports indicate that the People's Republic of California:

- Needs to float $13B to $15B in debt to stay afloat,

- The interest rate they are offering is not attractive to investors,

- The return they would have to offer to generate interested buyers they cannot afford,

- They need the money,

- They want to offer the lower interest rate and have the US Government guarantee the bonds in case they default,

- Such US guarantees are the burden of the US Tax Payers in the event of default,

- California says they won't default because they are going to tax their citiziens to pay for the bonds,

- Californians love to pay taxes and will not take any action (like leave the state) so with this in mind plus US taxpayer guarantees, investors (like insolvent Citigroup) will buy the bonds,

- And, just like Freddie, Fannie, GM, AIG, and so on, if this works out they will be back next quarter for more money because nothing is going to change in the short term to fix their underlying problems....

Your humble oracle blogger predicted this would happen back on October 26th, 2008.

What does all of this have to do with my long awaited treatise on why we will have a global currency to replace the US dollar? Here is a clue: It is not considered debt if you never plan to pay it back.

Saturday, April 11, 2009

Secret Societies Are Your Friend

The following groups are working tirelessly on behalf of Europeans, Japanese, and those living in the Americas:

Conspiracy theorists call these groups "secret societies" and assign to them all manner of frightening objectives including, but not limited to, enslaving the world. In fact, these groups are made up of the elite of the elite and the common person shouldn't flatter themselves to think this "Overclass" is the least bit interested in controlling the masses. They already have all the power and money. Their mission? - To Look Forward, Taking Action to Protect Our Way of Life.

By the middle of the 20th century, it became abundantly clear to small group of intelligent, experienced, rich and powerful people, that the elected, self-interested, self-absorbed leaders of the "free world" each seeking to advance themselves and act in their own country's self-interest would be incapable of maintaining our way of life. An Overclass that could effectively scenario plan the future and guide free world leaders without the appearance of "control" was needed. An thus, these 3 groups, many of which share members emerged.

With access to information, the power to control economic outcomes, broad minded independence coupled with uncanny abilities in scenario planning and "game theory", these groups effectively:

- Halted the spread of Russian catalyzed Communism,

- Prevented thermonuclear war,

- Ensured ample supplies of money and cheap energy to generally advance society.

Point 3 is very important. Energy is nearly free-- even at $150 a barrel for oil! Could you image how much the last 60 years would have cost us if were to make all these technological and economic strides still using horses, oxen and steam power? Could you imagine how constrained our economies would be if we still based our currencies on some selected precious metal rather than using a debt based system that allowed for sustained, expansive growth?

No one country, no one person could have accomplished point 3. It required the Overclass, with a patient yet comprehensive blueprint, to guide the cacophony of nation states to get us where we are today.

As I said, if this story isn't true, it should be.

Monday, April 06, 2009

US Unemployment Reaches 16%

This statistic is largely under-reported but easily found at the US Bureau of Labor Statistics. Go here and access U6 to see the data. The point being, that the rise of the US Consumer requires confidence. And if you are marginally attached, discouraged, or under-employed you are less like to take consumer risk. Unless of course, you are borrowing just to survive. Then consumer risk becomes credit risk.

Chart was originally posted here. Click on graph to enlarge.

Saturday, April 04, 2009

Easy Go; Easy Come

Will you ever be as wealthy again as you were at the begining of 2008?

Here's some hope.

There are about 250 trading days in the New York stock market each year. International markets vary but they are all around 250 or so. If your current holdings simply increase 3/10 of 1 Percent (0.30%) every day for a year, you will double you money.

You're back baby!!!!

Does this give you hope? If so, then you need to read This posting from 2005.

Sunday, March 29, 2009

A New Casualty From The AIG Scandal

Apparently, our "free press" was told not to report on where the money was really going because of fears of backlash by the American people. It is more important for the American people to mad at people on wall street and NOT be angry with their government.

Now it appears that a CNBC Host, Dylan Rattigan, broke ranks and started talking a

bout the real AIG scandal. You can watch the events unfold here as he starts talking about the issue surprising the three guests who were there to talk about the DOW. Notice also that after a little discomfort, they admit that it is the "REAL UNTOLD STORY" and then you see them actually wanting to talk about the issue. Video is here:

bout the real AIG scandal. You can watch the events unfold here as he starts talking about the issue surprising the three guests who were there to talk about the DOW. Notice also that after a little discomfort, they admit that it is the "REAL UNTOLD STORY" and then you see them actually wanting to talk about the issue. Video is here:http://economicedge.blogspot.com/2009/03/this-is-way-america-really-works.html

It seems the executive management of CNBC were outraged and forced the show to cut away to announce what is laughable "breaking news" that GOOGLE is going to layoff 200 people. It was reported that, during the cut away, Dylan Rattigan was fired and did not appear on the show he hosts in the evening called "Fast Money".

And as usual, news of his termination is now being "spun" so that everyone thinks that there are contract issues with Dylan and also sending out stories to discredit him as a professional and a human being.

So let me summarize:

(1) The AIG scandal concerning sending US taxpayer dollars to bailout EU banks was already public information, easy to locate and I was able to publish the details more than a week ago on this blog.

(2) There is nothing wrong with AIG sending money to the EU banks because after all it was a contractual obligation-- no laws broken as far as I can tell.

(3) But it looks bad. And that makes the US Government look bad. At a time when they want to look good. I feel sorry for them because all they have is their image. Because they have no business skills, they are ill-equiped to deal with the problem. Because they have no leadership abilities, they can't allow what must (and eventually will occur) which is a lot of pain for the American people [Deflation, Inflation, Currency Devaluation, Income Confiscation through higer taxes]. So they are taking advice from the very people who caused the problem in the first place.

(4) The "free press" is no longer free. They are being told what can and cannot be reported. And, if you do try to do some investigative reporting and don't clear it with your network executive, you will get fired. And your famiy won't eat. And as soon as we get government run healthcare in place, we will take away your healthcare if you don't do as we say.

I liked Dylan, I hope he goes to Bloomberg or Fox Businesses. I have been drifting from CNBC viewership for some time now... Now I won't watch them at all.

Friday, March 20, 2009

The Bulldog Returns

Whew.... now with out of the way. I am working on 2 strategies both based on China. The reason these strategies exist is posted here.

STRATEGY 1: CHINA RECOVERY

DBB: ETF for aluminum, zinc and copper

FXI: ETF for top 25 Chinese companies

UDN: ETF for shorting the US Dollar.

STRATEGY 2: COMMODITY RECOVERY

USL: ETF for United States 12 month oil

DIG: ETF PROSHares ultra leveraged long term energy

ENY: ETF for Canadian Energy (stay away from US companies unless ultra leveraged)

GLD: ETF for Gold

EGO: Canadian Gold Mining Stock (probably best financial fundamentals of gold miners)

UND: ETF for shorting the US Dollar

Of the two, I like Strategy #2 the best, since OIL crossed its 50DMA this week. OIL should move to $60-65US by end of 2009 because China has locked up reserves in Russia and Venezuela using excess US dollars in the Central Bank of China (afterall they can't keep buying US treasuries with those dollars earned from imbalance of payments). This move, along with the fact that Mexico will be a net importer of oil in 2010, will move all other buyers to the spot market. Also, remember that China has been providing engineering and financial aid to Iran and Iraq as well as selected countries in Africa for mineral rights.

The only downside I see here could come from a decision by the US government to sell Alaska to the Chinese to pay down the US debt or provide temporary jobs to displaced US workers. Other than that, I think this is pretty sound.

Wednesday, March 18, 2009

US Taxpayers to bailout European Union

AIG massive payments to banks stoke bailout rage

REUTERS — 2:03 PM ET 03/16/09 By John O'Callaghan and Lilla Zuill

Translation: US Taxpayers just pushed $30B more into AIG to prop it up and AIG sent all of it to Europe. If that wasn't bad enough, US politicians and the US news media are focusing on the $165million in bonuses paid to AIG employees to distract the US Taxpayer from what is really going on.

"The call for "realistic" expectations is in stark contrast to the hopes of a "new global deal" at the G20 summit espoused by Gordon Brown, the Prime Minister, who will host the meeting on 2 April in London...Doubts surfaced over the likelihood of agreement after France and Germany spoke out against the co-ordinated fiscal stimulus that Mr Brown and the US President see as vital."

Darling plays down hope of G20 plan to save world economy

Published Date: 14 March 2009 By Gerri Peev

Translation: As long as the US government is willing to pull the train; the EU is willing to ride. And why not? Why should the EU risk inflation and currency devaluation when the US is so willing to print money and take on debt.

Monday, March 16, 2009

Beware the SECOND DERIVATIVE

Which qualifies me to advise you to "Beware the purveyors of the second derivative". These are the people who tell you that they are seeing positive indicators in the economy. What are the measuring? They are measuring the change in the change.

And, you should know that even when the change in the change is positive, it can still be negative.

Class, Dismissed!

Friday, March 13, 2009

Wednesday, March 11, 2009

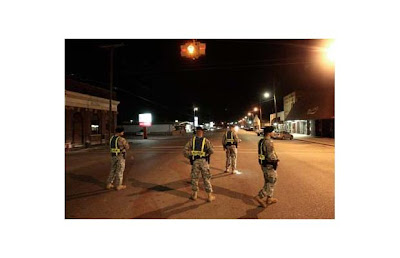

Not Legal

If the caption of the photographer is correct, then in the United States this is illegal. If they are Police SWAT (Special Weapons and Tactics) or the National Guard then it is OK. However, calling out the National Guard for a minor domestic disturbance is at least troubling.

U.S. Army soldiers patrol the streets of Samson, Ala., after a man killed 11 people, including his mother, in a shooting rampage before turning the gun on himself on Tuesday afternoon. Photograph by: Mark Wallheiser, Reuters

Sunday, March 08, 2009

Where is the AIG bailout money going?

(1) AIG is an insurance company.

(2) Of the many things they insure, financial instruments is one of them.

(3) Banks hold financial instruments (like CDOs) and they want to protect their investment a little by buying insurance from AIG which basically means that the Banks will get their money if the CDOs default because AIG has insured them.

(4) The CDOs default.

(5) AIG needs to pay the banks the insurance.

(6) Lot's of defaults occur and AIG runs out of money.

(7) So.... the USG gives/lends AIG money (billions) but it only passes through AIG to the banks in the form of insurance payouts. It is just another way of channeling money to banks.

Once all the insurance policies are paid off there will be no need for AIG to exist as an insurer of financial instruments. AIG will be allowed to declare bankruptcy which means the USG won't get paid back all the billions they (you) lent them.

Wednesday, March 04, 2009

The Trashing of Mark-to-Market Accounting

The drum beat on the news is that we must suspend the Mark-to-Market rule! MTM is killing our financial institutions! And so on....

What is MTM? Mark-to-market, or fair value, accounting rules require financial companies to value assets based on what they could fetch in a current market transaction. Seems reasonable? Let's see how Mark-to-Market concepts work in the real world....

Our World - Two ordinary people: Let's assume you want to sell me your car. We could look up the market value of this car in a number of sources and that becomes the basis for our negotiation. And maybe I agree to pay a little more or a little less than the appraised value but if it is an honest transaction where no one is hiding anything, generally the deal is made at or near the market value.

The financial world: Banks have all these bad loans on their books. And nobody wants them. What do you think these loans are worth? A lot less than what the banks lent for sure. But the banks say, "if I have to show these loans on my books based on what I could sell them for, then I will be insolvent!" Too many liabilities and too few assets. I am too big to fail!!!!! And if I fail, you are going to be very, very unhappy. In fact, until you take these bad loans off my books or give me some way to say they are worth more than they are, I am not going to lend any money.

And so my dear readers, the drum beat begins. Everyone will start talking about how Mark-to-Market is killing our economy, destroying lives and ruining our society. Anyone who opposes repealing this rule will be swept aside or personally attacked.

But here is the best part.... only financial institutions will be exempt from Mark-to-Market rules. They will get to decide what their assets are worth not the market.

The rest of us, well, we are at the mercy of "bend over" Bernanke and the Central Banks of so many of your countries. Your house, your car, your investments, your business will be worth what the market says it is worth.

Mark my words.... you are marked to the market.....